Am I Eligible To Make a Lump Sum Claim?

In New South Wales, the Compulsory Third Party (CTP) insurance scheme provides compensation for individuals who sustain serious and permanent non-threshold injuries in motor vehicle accidents. This compensation, known as lump sum compensation, is designed to assist accident victims in their recovery and provide financial support for their long-term needs.

FAULT-BASED SYSTEM

Proving fault is essential to the success of your lump sum compensation claim.

In New South Wales, the CTP insurance scheme operates on a fault-based system.

This means that to be eligible for lump sum compensation, you must demonstrate that another individual or entity was at fault, either wholly or partially, for the motor vehicle accident that resulted in your injuries.

THRESHOLD AND NON-THRESHOLD INJURY

While the injuries you sustained in your motor vehicle accident may have had major impact on your life, there is a definition of ‘threshold’ (previously known as minor injury) and ‘non-threshold’ injury in the legislation.

To be eligible for CTP lump sum compensation you must have sustained injuries in a motor vehicle accident and those injuries must be assessed as meeting the definition of ‘non-threshold’ injury.

TERM

Physical Non-Threshold Injury

- Fractures

- Nerve Injury

- Tendons, cartilage or ligament ruptures

- Spinal nerve root under 'radiculopathy'

Psychological Non-Threshold Injury

- Depression

- Post-traumatic stress disorder (PTSD)

LODGING YOUR LUMP SUM CLAIM

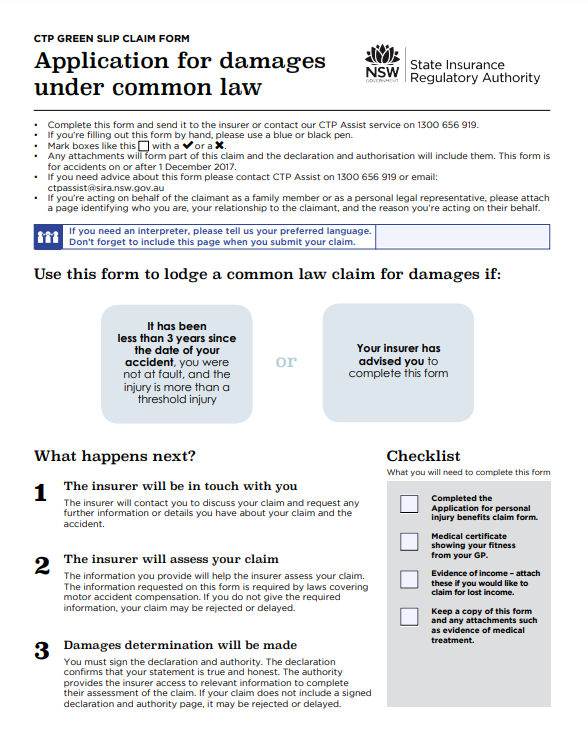

To start the claims process, you should complete the Application for Common Law Damages claim form.

The form is very straightforward.

Once completed, ensure that the form is signed on the designated pages and submitted to the CTP insurer responsible for handling your compensation claim. This initiates the formal process of seeking lump sum compensation.

WHAT IF MY CLAIM IS REJECTED

Your claim for lump sum compensation may be rejected by the CTP insurer. Here are a few reasons your claim may be rejected:

YOU WERE AT FAULT

If the accident was determined to be your fault, you may not be eligible for a lump sum claim. However, some accidents may involve shared responsibility known as contributory negligence, where both drivers are partially at fault.

If your claim involves an issue of contributory negligence, you might still be able to claim a lump sum, though the payment could be reduced to account for your contributory negligence.

This is complex, so we strongly recommend that you engage the services of an expert CTP lawyer to assist you with your claim.

YOU SUFFERED THRESHOLD (MINOR) INJURIES

If the CTP insurer has categorised your injuries as a threshold (or minor) injury, you are not eligible for lump sum compensation.

It is important to know that you can request an internal review of the insurer’s threshold injury decision. You must do so within 28 days. You can submit new evidence to the CTP insurer and request that it reconsider the threshold injury decision.

NON-ECONOMIC LOSS AND <11% IMPAIRMENT

If you were retired at the time of the accident or not working for some other reason and had no intention of returning to work, then your lump sum claim for compensation will be limited to compensation for pain and suffering only.

You are only entitled to receive compensation for pain and suffering if your injuries are assessed at greater than 11% whole person impairment. This means you do not have any entitlement to lump sum compensation if your whole person impairment is assessed at under 11% and you have no claim for past or future loss of earnings.

Whole person impairment is calculated by a medical specialist trained in the use of the guidelines for the evaluation of permanent impairment

TIME LIMITS

You must make your lump sum compensation claim within three years of the date of the accident.

If you are assessed as having a whole person impairment greater than 10% then you can make your lump sum claim at any time.

A rejected claim doesn't mean the end of the process. Contact CTP Claim Guide for more assistance on challenging the decision made to get you the compensation you deserve.

MORE INFORMATION

SEEKING LEGAL REPRESENTATION

Navigating the complex process of claiming CTP lump sum compensation can be overwhelming for victims dealing with serious injuries and the emotional aftermath of a motor vehicle accident.

A personal injury lawyer who specialises in CTP claims can be an invaluable ally during this challenging time. To ensure a smooth and successful personal injury claim process, consult with an expert CTP lawyer who can provide the necessary expertise and support to help you secure the compensation you deserve.

CLAIM TIME LIMITS

Time limits are in place for lodging a lump sum damages claim.

In New South Wales (NSW), the time limit for motor vehicle accident claims is generally three years from the date of the accident.

It is important to take prompt action and seek legal advice to ensure compliance with the relevant time frames.

FREQUENTLY ASKED QUESTIONS

CONTACT US

Submit the form below and we will have one of our expert CTP lawyers reach out to learn more about you and your circumstances and see if you are eligible. Start the CTP claim process now to get the compensation you deserve.